Did you know that a staggering 82% of small businesses stall due to inadequate cash flow management or a lack of understanding of cash flow?

This eye-opening statistic confirms even more the utmost importance of cash flow for the financial health and growth of any business.

If the whole concept of cash flow and cash flow formulas is new to you, no need to worry.

We’ll provide you with a great starting point and show you how to calculate cash flows to keep your finances in check.

Let’s dive in!

What Is A Cash Flow?

Cash flow refers to the movement of money into and out of a business, or in other words, the inflow and outflow of cash and cash equivalents over a specific period.

It is a super-important financial metric that reflects a company's ability to generate cash and manage its operating activities effectively.

3 Main Components of Cash Flow

In order to fully understand not only the way cash flow works but also cash flow formulas, you should know more about 3 key cash flow components.

- Operating Activities — Includes cash flow from transactions related to your company's core business operations, such as sales, purchases, production costs, and expenses.

Positive cash flow from operating activities indicates that a company's primary business generates cash.

- Investing Activities — Refers to cash transactions regarding investments in assets, acquisitions, and capital expenditures.

- Financing Activities — Includes cash transactions referring to raising capital, repaying debt, issuing stock, and paying dividends.

This component shows how a company finances its operations and growth.

What are The 6 Types of Cash Flow Formulas And How to Calculate Them?

The main types of cash flow formulas revolve around the 3 main components above.

Each cash formula type serves a distinct purpose and tells you different things about your business.

So, let’s start with the most general one and work our way down.

1. How to Calculate Net Cash Formula?

Net cash represents the total cash inflows and outflows during a certain period, providing insights into your company's liquidity and cash position.

A positive net cash value indicates that your business generated more cash than it spent during the period, reflecting a healthy cash flow position.

On the other hand, a negative net cash value suggests that the business spent more cash than it generated, signaling potential liquidity challenges.

When to Use It?

Considering that net cash comprises your business’s overall financial performance, you should use the formula to get valuable insights into your company's cash flow dynamics, operational efficiency, and financial health.

2. How to Calculate Operating Cash Flow Formula?

Operating cash flow reflects the cash generated from your company's core operating activities. To calculate operating cash flow, you’ll first need to know the net cash value.

On top of that, the other 2 key components are:

- Non-cash Expenses or Depreciation — Cover expenses such as depreciation, amortization, and stock-based compensation that don’t involve cash outflows.

- Changes in Working Capital — Refers to changes in the company's working capital accounts, such as accounts receivable and payable and inventory, over the period.

An increase in working capital represents a cash outflow, while a decrease indicates a cash inflow.

When to Use It?

Since operating cash excludes cash flows from investing and financing activities, you can use the formula to check your company's ability to generate sustainable cash flow from its primary business activities.

3. How to Calculate Investing Cash Flow Formula?

Unlike operating cash flow, investing cash flow involves determining net cash regarding your company’s investments in assets, acquisitions, and capital expenditures.

To calculate investing cash flow, you’ll need to determine the following components:

- Cash Inflows from Investing Activities — Cash you receive from the sale of long-term assets, investments, or any other cash inflows related to investing activities.

It also involves dividends you receive from investments in other companies.

- Cash Outflows from Investing Activities — Encompasses cash payments for the acquisition of fixed assets, investments in securities, business acquisitions, or any other cash outflows associated with investing activities.

When to Use It?

Calculating investing cash flow is crucial for assessing your company's investment decisions and capital allocation strategy.

It evaluates how effectively your business manages its capital investments, acquires long-term assets, and generates ROI so you can make informed decisions about future investments.

4. How to Calculate Financing Cash Flow Formula?

Calculating cash flow from financing activities involves evaluating the cash inflows and outflows related to your company's financing decisions, such as:

- Borrowing,

- Issuing stock,

- Repaying debt, and

- Dividends.

There are 2 components you need to factor in when calculating the financing cash flow formula:

- Cash Inflows from Financing Activities — Cash you obtain from issuing stock, taking out loans, issuing bonds, or any other cash received from financing transactions or stockholders or investors.

- Cash Outflows from Financing Activities — Cash payments for repurchasing stock, paying dividends, repaying debt, or other cash payments, including interest payments on debt.

When to Use It?

Analyzing financing cash flow gives an overview of how your business funds its operations and growth, manages its financial obligations, and returns value to investors.

5. How to Calculate Free Cash Flow Formula?

Free Cash Flow (FCF) is a key financial metric that represents the cash flow available to your company after accounting for capital expenditures and operating expenses.

Calculating free cash flow indicates the cash your business generates and that you can use for expansion, debt repayment, dividends, or other investment opportunities.

Let’s break down the components of the FCF formula:

- Net Cash from Operating Activities — You should know this ‘guy’ by now. It refers to your company's core operating activities, excluding investments, financing, and tax activities.

- Capital expenditures (CapEx) — Money you spend on acquiring, upgrading, or maintaining physical assets such as property, equipment, or infrastructure.

A positive Free Cash Flow indicates that your company has generated more cash than it has spent on capital investments, suggesting financial health and potential for growth. Conversely, a negative Free Cash Flow may suggest that your company spends more on investments than what it generates from its core operations.

When to Use It?

The FCF formula is a go-to option for making informed decisions about capital allocation, resource management, investment opportunities, and strategic financial planning.

6. How to Calculate Cash Flow Forecast Formula?

A cash flow forecast, or a cash flow projection, is an estimate of the cash inflows and outflows you expect over a future period, typically monthly, quarterly, or annually.

Thus, it helps you anticipate your future cash positions, forecast liquidity needs, and make informed financial decisions.

Key formula components:

- Beginning Cash Balance — The company's initial cash balance at the beginning of the period for which you are forecasting cash flow.

- Projected Cash Inflows — Estimate all sources of cash inflows you expect during the forecast period, such as revenue from sales, investments, loans, and other sources of income.

- Projected Cash Outflows — Estimate all expected cash outflows during the forecast period, such as operating costs, salaries, rent, loan repayments, and other cash payments.

When to Use It?

One of the biggest perks of calculating a cash flow forecast is to anticipate your business’s needs and identify potential cash flow gaps or surpluses.

You can proactively optimize financial resources if you regularly update and adjust the forecast based on actual performance and changing circumstances.

How Can Your Business Benefit From Cash Flow Analysis?

First and foremost, regular cash flow analysis helps maintain your business's financial health and increases the possibility of long-term success.

In addition, cash flow analysis:

✨ Ensures Sufficient Cash Reserves — Enables you to assess your liquidity position to ensure you have sufficient cash on hand to meet short-term obligations, such as payroll, rent, and supplier payments

✨ Facilitates Budgeting and Planning — Clearly shows expected inflows and outflows so you can develop accurate budgets and forecasts for future periods.

✨ Highlights Cash Flow Trends — Enables you to identify cash flow trends over time and anticipate fluctuations to know how to adapt to changing market conditions.

✨ Enhances Investor Confidence — Consistent and transparent analysis shows responsible financial management and can boost investor confidence in your company's ability to meet financial obligations and sustain long-term growth.

✨ Optimizes Working Capital Management — Helps you monitor accounts receivable and payable and inventory levels to maintain liquidity and improve cash position.

Overall, regular cash flow analysis helps you navigate financial challenges successfully.

Let’s Wrap It Up

The good news is that you can leverage the benefits of cash flow management thanks to financial software.

As a result, you no longer have to get lost in countless spreadsheets, calculations, and manual entries.

On top of that, financial software and tools can not only automate the majority of tedious and otherwise error-prone tasks, but they can also be a valuable asset in providing:

💣 Multiple banking capabilities,

💣 Loan access and

💣 Cash flow management and planning.

Puls Project can help you do just that: enhance the management, oversight, and operational efficiency of financial activities. 🚀

How to Calculate Cash Flow With Puls Project?

Puls Project is an all-encompassing financial planning system based on AI and ML technology that helps you avoid the most common mistakes regarding cash flow calculations.

Thus, with our tool, you don’t have to worry about overlooking changes in working capital, misclassifying cash flows, etc.

You wonder how?

🔥 By automatically calculating all your incomes and expenses and displaying them in a single dashboard.

Therefore, you can see all the transactions from multiple banking accounts without switching neither platforms or tabs.

What else is in store for you?

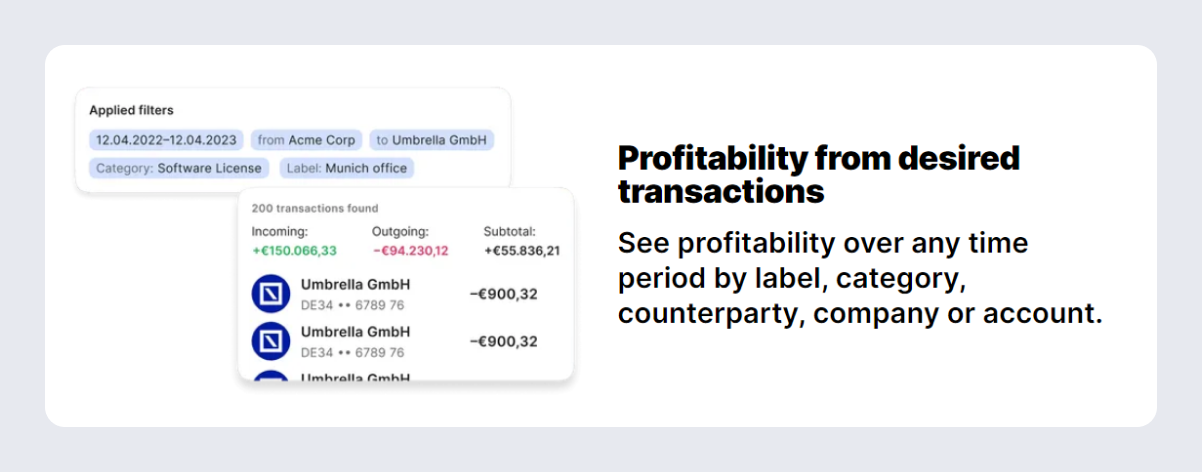

🔥 Analyze profitability over any time period by label, category, counterpart

, company, or account.

🔥 Link any bank account from over 4,000 banks to Puls within one minute.

🔥 Plan different cash flow scenarios by adding a draft payment to see how it will impact your business immediately

🔥 Access credit limit and get up to €100,000 within at least 48 hours of your request.

🔥 Increase your potential loan limit by doing more transactions via the Puls platform—the more banking accounts you connect, the bigger the loan limit can be.

🔥 Rest assured, knowing your data is secure due to finAPI, the GDPR-compliant service provider that will link your bank accounts to our system, with the access to the accounts strictly read-only.

Ready to take a plunge into Puls Project waters?

Register now and convert financial challenges into gains.